Introduction

This summary provides an overview of the current stock market trends, key indices, market news, and notable stocks as of November 27, 2024. It focuses on the performance of Indian indices and their global counterparts, highlights significant stocks to watch, and analyzes trading trends and investor sentiment.

Key Points

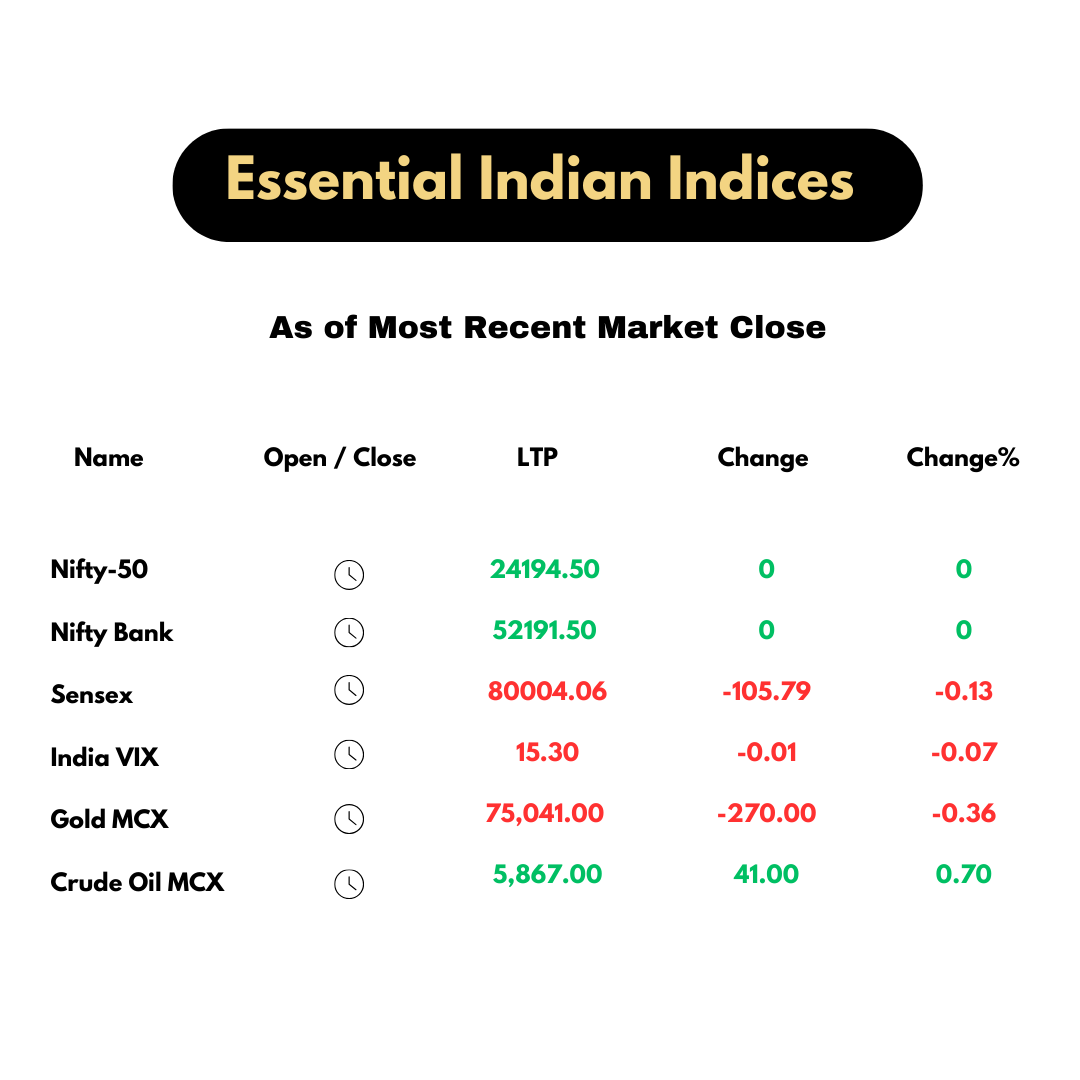

Market Overview

– The GIFT Nifty, an indicator of market sentiment, is trading slightly higher, indicating a flat to positive opening for the day.

– The NSE Nifty 50 and BSE Sensex saw a decline, reversing a two-session rally due to falling shares of Mahindra & Mahindra Ltd. and Larsen & Toubro Ltd.

– Mixed results were observed in the Asia-Pacific region following a ceasefire deal between Israel and Hezbollah.

– In the U. S. , equity markets rose, particularly the S&P 500 and Nasdaq, encouraged by a rebound in technology stocks amidst a backdrop of potentially impactful trade discussions from former President Trump and Federal Reserve announcements.

U. S. Economic Indicators

– U. S. 10-year Treasury yields fell to 4. 30%, and the 2-year bond yield decreased to 4. 24%, indicating a shift in investor sentiment towards risk.

– The U. S. dollar depreciated slightly against major currencies.

– Most Asian currencies appreciated, led by the Thai Baht.

– Crude oil prices remained stable despite geopolitical tensions easing, and there was a slight dip in gold prices in anticipation of upcoming U. S. economic data.

Indian Market Performance

– The Indian rupee ended lower against the U. S. dollar at 84. 34 amid cautious trading from banks.

– A bearish candlestick pattern formed in Nifty 50, closing down by 0. 1% after a two-day rally, suggesting potential bearish market conditions while still maintaining a generally positive outlook above key moving averages.

Technical Analysis

– Nifty 50:

– Current support and resistance levels have been identified, with significant call open interest at 24,400 and put writing at 24,050.

– Nifty Bank:

– Despite a slight decline from a resistance level of 52,600, it has shown a consistent pattern of higher highs and higher lows, indicating a longer-term positive trend.

Notable Stocks

Bullish Stocks:

– NTPC Green is preparing for its market debut, drawing attention to both it and its parent company NTPC.

– Ola Electric launched a range of scooters to enhance electrification accessibility at varying price points.

– Various companies have secured significant contracts and partnerships, strengthening their market positions, including Sarveshwar Foods, RailTel Corp, and Wipro.

Bearish Stocks:

– Dabur India faces a GST demand, which may impact its stock performance.

– No stocks are currently under the Futures and Options (F&O) ban, indicating a more stable trading environment.

Foreign Investment Trends

– Foreign Institutional Investors (FIIs) were notably net sellers in the cash segment, with a significant selling amount recorded on November 26, 2024.

Market Sentiment Indicator

– The Put-Call Ratio (PCR) for various indices reflects market sentiment, with readings above 1 suggesting bullish sentiment while values below 1 indicate bearish tendencies. The recent drop in PCR for certain indices indicates increased caution among investors.

Conclusion

As of November 27, 2024, mixed signals are emerging from both the Indian and international markets. Key indices such as the NSE Nifty 50 and BSE Sensex have faced fluctuations influenced by various macroeconomic factors. While several stocks show bullish potential, there are underlying bearish pressures to monitor. The sentiment among investors appears cautious, reflected in recent trading activity and the net selling by foreign investors. Continued analysis of economic indicators and market trends will be crucial for determining future directions in market performance.

Leave A Comment